Two items of property uses come before the Peachtree City Council this Thursday evening.

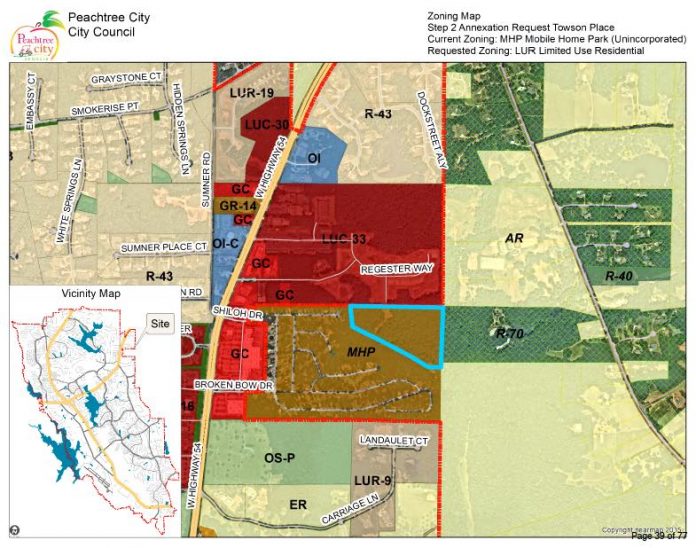

One is an annexation request from R.S. Towson Holdings, LLC, for annexation of slightly over 11 acres at the rear of a mobile home park into the city to allow construction of 20 single family homes.

Second is the adoption of a short-term rental ordinance which will limit and add red tape and fees to a homeowner’s attempt to turn part of her house into an Airbnb-style rental for up to 30 days.

More about the annexation request:

The site is currently zoned in the county for more mobile homes. The developer says he plans to build homes valued at an average of $850,000 each for about 70 additional residents.

City staff write that the added parcel would tie into the Towson Village subdivision already annexed and under construction. Staff generally approves of the project.

That wasn’t the case with the city Planning Commission. “The Planning Commission held a public hearing on this item at their October 23rd meeting. They voted 3-2 to recommend denial of the request,” staff wrote.

The newly minted short-term rental ordinance up for a public hearing Thursday evening is the city’s attempt to make some rules, set some parameters, collect some fees and ordain some penalties covering local residents who up until now have been free of rules and regulations about renting out space in their own homes.

The council started writing the rules this past spring, and the planning commission took a look at the proposals Sept. 25 and Oct. 9.

Here’s what the planning commission said about the rules package:

“• Increase application and renewal fees to $500. (Approved unanimously).

• Tier fines so that the first fine is $500, the second is $750, and the third is $1,000. (vote 4-1 with Commissioner Reeves preferring all fines to stay at $1,000).

• Increase the minimum age of the local contact agent to 25. (Vote 4-1 with one commissioner believing that the age should be lowered to 18).

• Change the requirement of the local contact agent to be located within 20 miles of Peachtree City or 1 hour travel time. (Approved unanimously).

• Reduce the notification radius from 500 feet to 200 feet. (Vote 3-2 with Commissioner Reeves wanting the radius to stay at 500 feet and Commissioner Hamner wanting the notification requirement eliminated altogether).

• Require an Occupational Tax Certificate for every Short Term Rental. (Approved unanimously).

• Continue to require the background check. (Vote 4-1 with Commissioner Hamner wanting the requirement removed).

But those recommended changes are not what the council will be looking at Thursday. “The draft of the ordinance attached to this memo and presented at this public hearing is the draft presented to the Planning Commission without their recommended changes. Should Council accept these recommendations from the Planning Commission, the motion should be stated so that the approval includes these recommendations.”

The main thing is that to legally rent out a room of your house in Peachtree City from now on, you will have apply for a yearly permit — for a fee — and your entire home will have to pass inspection. The city will limit the number of permits allowed to 1.5% of housing units within the city. Violations will cost up to $1,000 each.

The council also will consider saying goodbye to its current tennis center management company — Sequoia Tennis Management Inc. — and figuring out what comes next.

The council also plans to buy nine new police department vehicles for around $612,000.

Predictably, the annexation passed Thursday night 3 to 2. I am confident The new year will bring different results when similar votes take place.

Adding $850,000 housing for around 70 folks sounds like a good thing to me..YMMV.

It did not sound so good to the Planning Commission.

So I figure you live on undeveloped acreage?

For one, you should bear the costs of inspections to ensure safety and compliance with city codes. No one should subsidize your business with our tax dollars.

If you want an outrageous property grab by the government to rant about, try the death tax.

Hi Penny – I hope you have a nice Thanksgiving next Thursday.

I’m impressed that you are in the rarefied financial situation that your family’s estate is above $13,000,000 so that the “death tax” affects you. Good for you!

I’ve always looked upon estate taxes as tariffs wielded against the most fortunate, and like all tariffs, they are economic tools to advantage one group at the expense of another.

ST Fiction: something does not have to impact you to be outrageous. The fact the government can grab hard earned assets that have already been taxed merely due to the passing of someone is nonsense.

The federal estate tax does hit small business owners and farmers, whose survivors often are forced to sell to pay the taxes. There are also state estate and inheritance taxes that do the same thing.

Your comment is classic socialist government-forced redistribution from those who earned something to those who have not earned it.

Happy Thanksgiving to you as well.

Hi Penny – Perhaps you misunderstand me. I’m not necessarily endorsing estate taxes, merely pointing out that our government constantly picks winners and losers with tariffs, property tax mill rates, handouts to farmers, college students, the poor, etc. It is true with both parties. For instance, the tariffs imposed on China to support American manufacturers and intellectual property by President Trump have been largely unchanged by President Biden.

The issue of how the U.S. government should collect money is a larger discussion than this blog will allow. Should we tax income, consumption, wealth, etc.?

At any rate, I hope your family will be affected by the “death tax” because that means that your family is doing very well. Again, happy Thanksgiving.

Hate to break it to you, but there’s no guarantee in this country to not be taxed twice. In fact, the taxing power is concurrently held by both the Federal and the State governments, so that’s AT LEAST twice from the start.

To your second bit, it is laughable that you apparently think someone “earns” an inheritance by the virtue of their birth. They don’t.

blake – I said nothing about the merits of receiving an inheritance, so you need to re-read my comment. Just pointed out to Defins that death taxes are far less justifiable than fees for him to have rentals.

Why the hell should the govt get anything if I want to rent out MY PROPERTY? What country do we live in? Outrageous.

We live in the United States of America, a country allowing many liberties. Our governments’, federal, state, county and municipal, purpose are to protect. The Peachtree City City Council is attempting to protect us from people acting irresponsibly in and toward our community There are some who live here and are opportunists, without caring how their enterprises impact our community.