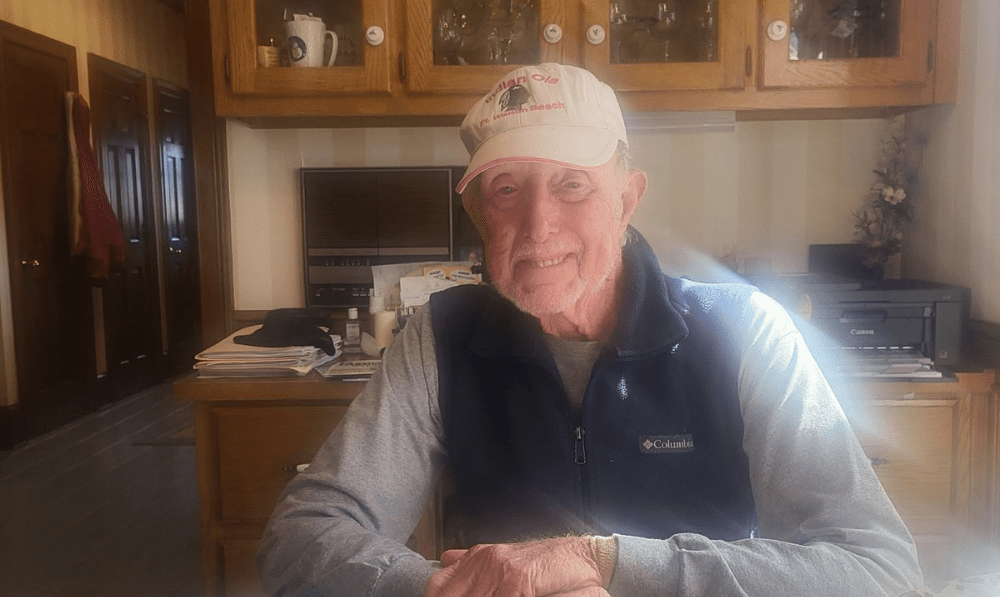

When I interviewed 93-year-old James McMaster, he answered the phone with the kind of unvarnished candor that makes you lean in.

“I’m as well as I can be for 93,” he said. A beat later, speaking of First Liberty founder Brant Frost IV — the man whose investment operation has now been exposed as one of Georgia’s largest Ponzi schemes — he added, “They all ought to be in shackles.”

McMaster is one of the largest known victims in a scandal that has already cost investors more than $140 million. Some news reports say the total may rise significantly, potentially approaching or exceeding $200 million — far higher than originally reported.

Our previous reporting chronicled the unfolding investigation and the people harmed along the way:

SEC shuts down First Liberty Building & Loan

Anonymous investor loses $1.1 million

Jamie Sickert’s hidden history

A life built by grit

McMaster was born in Whittier, California, the son of sharecroppers. He started working at age 12 — washing dishes, bussing tables, and learning the restaurant business from a Greek family who “took me under their wing.”

In his early 20s, he became a single father. His daughter was an infant, his son a bit older. His wife “said, ‘You take one, I’ll take the other.’ I took my daughter,” he told me. He raised her alone — rare for that era.

Later, in the meat-packing industry, he rose from truck driver to plant manager, then corporate shareholder. By the mid-1980s, he was part of a leveraged buyout of a national company with more than $700 million in annual sales.

He retired in his early 50s. “I haven’t had a paycheck since 1985,” he said, “and I’ve lived fine.”

Today, he tends his Hampton acreage, rides his backhoe, grows vegetables, and cares for an elderly horse and the cat that rides it. He studies the Bible daily with his 94-year-old sister. He is, as his friend Lisa Deveraux describes him, “one in a million.”

Why First Liberty appealed to him

McMaster doesn’t watch television. He listens to WSB Talk Radio throughout the day — Mark Arum in the mornings, Shelley Wynter at night. But it was Erick Erickson’s midday show where he repeatedly heard First Liberty’s advertising and, at times, Erickson’s own on-air praise of the Frost family.

“They talked about them like they were a good Christian family,” McMaster said. “You believe the people you listen to.”

He visited First Liberty’s office in downtown Newnan, met office manager Jamie Sickert, and sat down for coffee with Brant Frost IV. He even ran a background check on Frost IV — which showed some old infractions, but no convictions.

Everything appeared legitimate.

The $1.3 million loss

Through First Liberty, McMaster invested in a mortgage pool, a 7,000-square-foot luxury home project in Highlands, North Carolina, and a loan secured by an assisted-living facility in Athens. He inspected the Athens property himself.

“It was real. You could see it,” he said.

Monthly payments arrived early — sometimes before the due date.

“That was the first time in my life that ever happened,” McMaster said. “It came like clockwork.”

Over time, he invested $1.3 million through First Liberty— about 80% of his liquid assets, but nowhere near his full net worth. McMaster remains financially secure.

Then, in June, he opened an email from Sickert while waiting at his doctor’s office. It announced all loans and operations had ceased.

When the nurse attempted to take his blood pressure, they couldn’t get a reading.

“Was it high?” I asked.

“Oh, sure,” he said. “When you think, ‘My God. One-point-three million.’”

A collapse bigger than first imagined

Early reports pegged losses at about $140 million. But with victims emerging in Georgia, Alabama, South Carolina, and beyond, some news reports indicate the total may rise significantly — potentially approaching or exceeding $200 million.

The SEC placed First Liberty into receivership under S. Gregory Hayes of Hays Financial Consulting in Atlanta. His public filings of Brant Frost IV’s assets list several older vehicles, one Aston Martin, and undefined “personal effects.”

Victims were stunned. The list bore no resemblance to the extensive collateral they believed existed.

Many, including McMaster, now believe meaningful restitution may ultimately come through litigation targeting banks that processed large wire transfers without flagging them — mirroring the Madoff recovery model.

Seeking justice

McMaster remains realistic but hopeful.

“I’m hoping this high-paid solicitor gets something done,” he said.

He wants accountability — for Frost IV, Frost V, Sickert, and anyone else responsible.

“They’ve got to pay the price,” he said.

Still standing — and still James

McMaster’s financial goal in his later years was simple: to avoid dipping into his principal so he could continue helping his 94-year-old sister with her care and leave something meaningful for the generations who will follow him. He has grandchildren, great-grandchildren, and—just recently—a great-great-grandchild. “I wanted their lives to be a little easier,” he told me. “Whether they appreciate it or not, who knows.”

He never imagined he would lose most of the cash he intended to pass down. Real estate will still form a substantial part of his estate, but the $1.3 million he placed with First Liberty represented what he hoped would become college funds, safety nets, and a financial foothold for the youngest members of his family. “I’ll still have a crumb to leave when I go,” he said. “But it would’ve been nice to have that one-point-three to add to it.”

He still owns his land, home, and extensive real estate holdings. He still works his property, studies scripture with his sister, and cares for the animals that keep him company.

As Deveraux puts it, “My life is better just knowing someone like him exists.”

The justice system should move quickly — while he is still here to see it.

Leave a Comment

You must be logged in to post a comment.