Detective Michelle Taylor of the Peachtree City Police Department sees all kinds of scams. Gift card scams like the one we covered last week in the Scam Series are common, so is someone requiring a cashier’s check, like our first week’s Scam Series article.

Det. Taylor said that legitimate businesses and governments do not need you to withdraw a lot of cash or a cashier’s check. She said that banks are mandated reporters, and should help to be a first line of defense for that kind of scam. She said, “Some of these people who are going in and they’ve been bank customers for 20, 30 years and all of a sudden they’re withdrawing $25,000 in cash. That’s usually a red flag to bank employees. And so they actually get training on some of the red flags to see, and they try to do it in such a customer service way, but to stop them and say, Hey, why are we withdrawing money today in such a big amount? And that’s one of those first lines of defenses.”

Forty percent of Fayette County residents bank with Delta Community Credit Union. So we asked them to share what they do to prevent fraud. According to Pam Davis, Senior Vice President of Branch Delivery & Operations, at Delta Community Credit Union, their staff are trained and have protocols they follow, “Delta Community regularly trains team members to recognize the different types of monetary scams, and financial abuse, and the appropriate actions to take when red flags are detected.”

Besides training frontline workers, DCCU said that they have “proactive fraud montitoring on certain high-risk transactions to spot fraud early and/or prompt outreach to consumers.”

Delta Community suggests that members regularly review their account activity on a daily or weekly basis as early reporting can prevent losses, and also to check their credit reports each year and report anything suspicious.

They also suggest that if you’ve fallen victim to fraud you contact your banking provider immediately, “because the earlier it is identified, the chance of recouping the losses increases. Members that fall victim to financial crimes are also advised to file a police report,” said Davis.

Delta Community also shared the following red flags:

- The offer/deal sounds too GOOD to be true and your gut instinct says it is a potential scam.

- You did not contact anyone at the company; they contacted you.

- You are asked to provide confidential and personal information.

- You are instructed to deposit a cashier’s check and/or send money to someone via Western Union or MoneyGram.

- They want you to pay for something like software, a credit report or equipment.

DCCU also suggests that you may want to sign up for “account alerts through our online and mobile banking channels to receive notifications about large withdrawals, end-of-day balances and/or other transactional activity.”

Following Delta Community’s tips might help, but it might not, as Det. Taylor said, “I honestly consider scammers to be an evolving organism. They learn what’s not working anymore and what is working. And we have had quite a few scams where they tell the victim, Hey, listen, the bank is going to tell you this is a scam. They literally tell ’em that that’s what’s going to be told to them because they know that the bank is telling people that.”

Taylor told a story about a couple who were nearly scammed with someone saying they were from the bank and naming specific bank employees that the couple recognized. “She said, ‘I realized, why would a bank employee tell me that they’re investigating another bank employee?’ That’s what the red flag was to her. And they hung up and told the bank what was going on and they were able to stop what they were doing before it got to a point where they lost money. But a lot of victims do fall for that.”

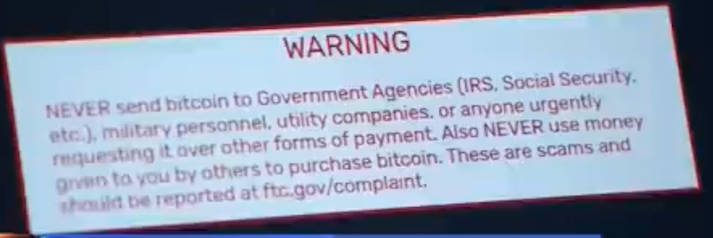

Det. Taylor has more suggestions of scam red flags. Cryptocurrency is a big one. Speaking to a group of seniors she said recently, respectfully, “Nobody your age really should be dealing in cryptocurrency, especially not putting cash into those crypto or Bitcoin ATMs that are at gas stations or the liquor stores. If you’re putting money into a Bitcoin ATM, you are 100% being scammed no matter what they’ve told you. I wish I could shout that to everybody.”

Local businessman Michael Hyde with PitStop Convenience Centers, says that no one should share the account details about the Bitcoin wallet that they form at their crypto ATM. The ATM, which also does regular cash withdrawals, converts crypto inside their store at Highway 74 and Crosstown in Peachtree City. They should never deposit into an account they didn’t open alone. He also says no one should be depositing huge amounts of money into a crypto ATM. There’s a reason why his ATM limits people to $1000 a day.

He says it’s a continuation of the gift card scams he used to see with people saying their $100 VISA gift card was to pay someone. Their cashiers would try to stop those scams, and are also trying to stop people from being scammed at the ATM. He says, for example, that the IRS will never ask to be paid in Bitcoin. Hyde said, “We want the people that want to do legitimate business. We do not want people draining their bank accounts for $4,000, $10,000, $40,000. We don’t need those customers.”

Hyde says he sees customers at his ATM who use their Bitcoin wallets as a sort of savings, and he says, “Crypto’s taken off. The federal government’s investing in crypto right now, so they’re doing a crypto reserve where they’re putting like 10 billion in Bitcoin to be able to trade it. So it’s becoming mainstream, like investing in gold and silver and other commodities. And so people are investing in crypto, and unfortunately there are people that are doing scams.”

And again regarding gift cards, Detective Taylor said, “There’s no entity that you would ever pay for a bill, a warrant, any kind of type of thing you owe in gift cards, and those are going to be people that will drain that gift card as soon as you give them the number and it’s like cash. It’s gone. We need to stop talking to strangers.”

What about when people call and say they are the bank, “You should hang up. Most of us, even people over 65 have banking apps on our phone. They should hang up, go to their app, or honestly, sometimes I say, go to your physical branch.”

She also says to avoid scams like the one that got last week’s victim, “Don’t ever call the phone number on a popup because they’re providing you with that number and it’s going to go straight to the scammer. If a popup comes up on your computer, use your phone to find your bank’s local number and call that.”

Detective Taylor agrees that it’s a good strategy to use the number on the back of your debit card that you have been using for a while, and that looking the number up online can be problematic, as you may have been compromised by the scammers, if you’re already looking at a pop-up.

Another way to avoid fraud, according to Det. Taylor is to stop mailing your checks from your mailbox. “We’re one of the top 10 states for check fraud.” Det. Taylor suggests that online bill pay is safer, or if you are mailing to take your check to the post office.

“I personally caught at least three people who were stealing mail out of mailboxes off of Peachtree Parkway. Anyone who had a mail flag up, they had their mail stolen one day. We were able to catch ’em, but still, these people weren’t from around here. They were from an hour and a half away.”

“Peachtree City is a safe place, but we really start to let our guard down because of that. Keep it safe by protecting yourself with some street smarts and some vigilance,” concluded Detective Taylor.