Two items of property uses come before the Peachtree City Council this Thursday evening.

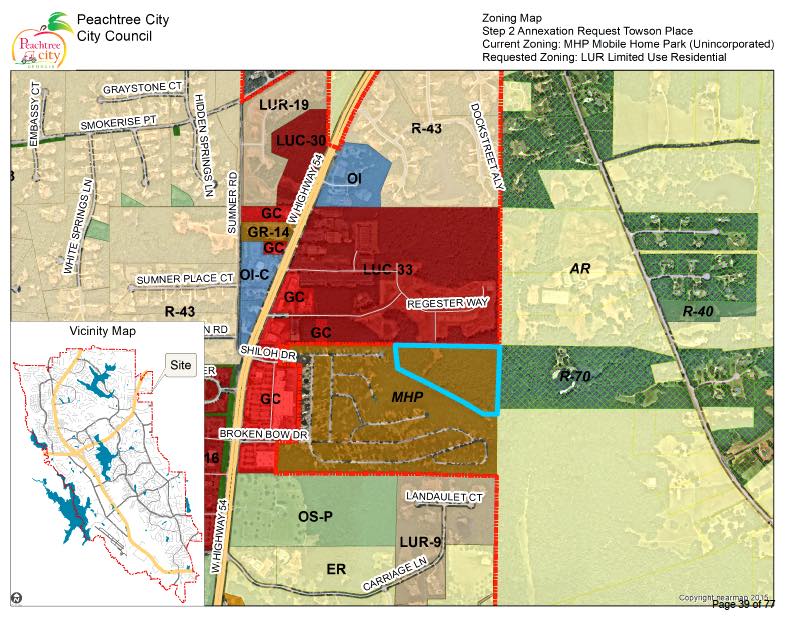

One is an annexation request from R.S. Towson Holdings, LLC, for annexation of slightly over 11 acres at the rear of a mobile home park into the city to allow construction of 20 single family homes.

Second is the adoption of a short-term rental ordinance which will limit and add red tape and fees to a homeowner’s attempt to turn part of her house into an Airbnb-style rental for up to 30 days.

More about the annexation request:

The site is currently zoned in the county for more mobile homes. The developer says he plans to build homes valued at an average of $850,000 each for about 70 additional residents.

City staff write that the added parcel would tie into the Towson Village subdivision already annexed and under construction. Staff generally approves of the project.

That wasn’t the case with the city Planning Commission. “The Planning Commission held a public hearing on this item at their October 23rd meeting. They voted 3-2 to recommend denial of the request,” staff wrote.

The newly minted short-term rental ordinance up for a public hearing Thursday evening is the city’s attempt to make some rules, set some parameters, collect some fees and ordain some penalties covering local residents who up until now have been free of rules and regulations about renting out space in their own homes.

The council started writing the rules this past spring, and the planning commission took a look at the proposals Sept. 25 and Oct. 9.

Here’s what the planning commission said about the rules package:

“• Increase application and renewal fees to $500. (Approved unanimously).

• Tier fines so that the first fine is $500, the second is $750, and the third is $1,000. (vote 4-1 with Commissioner Reeves preferring all fines to stay at $1,000).

• Increase the minimum age of the local contact agent to 25. (Vote 4-1 with one commissioner believing that the age should be lowered to 18).

• Change the requirement of the local contact agent to be located within 20 miles of Peachtree City or 1 hour travel time. (Approved unanimously).

• Reduce the notification radius from 500 feet to 200 feet. (Vote 3-2 with Commissioner Reeves wanting the radius to stay at 500 feet and Commissioner Hamner wanting the notification requirement eliminated altogether).

• Require an Occupational Tax Certificate for every Short Term Rental. (Approved unanimously).

• Continue to require the background check. (Vote 4-1 with Commissioner Hamner wanting the requirement removed).

But those recommended changes are not what the council will be looking at Thursday. “The draft of the ordinance attached to this memo and presented at this public hearing is the draft presented to the Planning Commission without their recommended changes. Should Council accept these recommendations from the Planning Commission, the motion should be stated so that the approval includes these recommendations.”

The main thing is that to legally rent out a room of your house in Peachtree City from now on, you will have apply for a yearly permit — for a fee — and your entire home will have to pass inspection. The city will limit the number of permits allowed to 1.5% of housing units within the city. Violations will cost up to $1,000 each.

The council also will consider saying goodbye to its current tennis center management company — Sequoia Tennis Management Inc. — and figuring out what comes next.

The council also plans to buy nine new police department vehicles for around $612,000.

Leave a Comment

You must be logged in to post a comment.