Expect higher property tax bills this year —

The numbers are in, with the 2020 Fayette County tax digest showing an overall 5.4 percent increase in real and personal property values in the county. Values rose in all the county’s municipalities and in the unincorporated areas.

Higher property values generally mean that local governments will receive more money even if they don’t change this year’s millage rate. Quick take for property taxpayers: Look for higher tax bills this year.

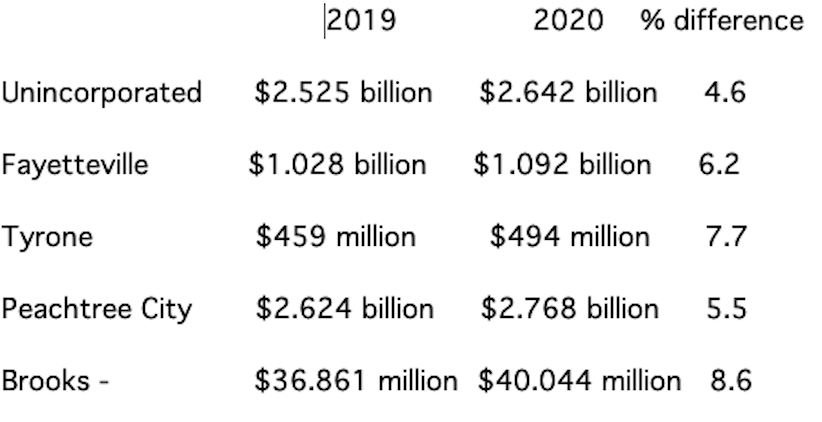

The 2020 tax digest numbers below, provided by Tax Commissioner Kristie King, are the 40 percent (fair market value) numbers on which property tax bills are based when combined with an individual jurisdiction’s millage rate.

For Fayette countywide, the 2019 tax digest came in $6,673,432,922, while the 2020 numbers totaled $7,036,571,676, representing a 5.44 percent increase.

As with figures countywide, all areas and jurisdictions throughout Fayette saw increases in real and personal property values over 2019.

Included below is a breakdown of the individual jurisdictions comparing 2019 to 2020:

Fayette’s other tax levying entity is the Fayette County Board of Education, which receives the large majority of property taxes paid by property owners.

Identical to Fayette countywide, the school board in 2019 levied taxes based on $6.673 billion in real and personal property values. In 2020, that figure rose to $7.036 billion.

Anyone familiar with Fayette County over a number of years understands that property values have been rising for decades, except for the years of the Great Recession.

It was in 2011 that the net digest totaled $4.789 billion. Yet as the effects of the Great Recession took hold, the county was hit hard by falling property values.

The net digest in 2012 shrunk to $4.3 billion, followed by a value of $4.32 billion in 2013 and $4.396 billion in 2014.

A slow but steady turn around came in 2015, with the net digest totaling $4.76 billion, followed by $5.03 billion in 2016, $5.62 billion in 2017 and $5.9 billion in 2018.

Leave a Comment

You must be logged in to post a comment.