Doctor gets $2.9 million under whistleblower statute after exposing what federal official called ‘greed-fueled schemes’ —

Piedmont Healthcare — owner of Piedmont Fayette Hospital in Fayetteville — in federal court on June 25 agreed to pay a $16 million settlement to resolve false claims allegations dealing with Medicare and Medicaid billing.

Piedmont Healthcare — owner of Piedmont Fayette Hospital in Fayetteville — in federal court on June 25 agreed to pay a $16 million settlement to resolve false claims allegations dealing with Medicare and Medicaid billing.

U.S. Attorney Byung J. “BJay” Pak for the Northern District of Georgia said Piedmont Healthcare agreed to pay $16 million to settle allegations that it violated the False Claims Act by billing Medicare and Medicaid for procedures at the more expensive inpatient level of care instead of the less costly outpatient or observation level of care.

Pak said the settlement also resolves allegations that Piedmont paid a commercially unreasonable and above fair market value to acquire Atlanta Cardiology Group in 2007 in violation of the federal Anti-Kickback Statute.

“Billing the government for unnecessary inpatient services wastes precious government resources and taxpayer dollars,” said Pak. “All appropriate action will be taken to ensure that beneficiaries of federal health care programs received services untainted by overcharges and improper financial incentives.”

Pak said the settlement resolves two separate False Claims Act allegations. First, between 2009 and 2013, Piedmont’s case managers allegedly overturned the judgment of its treating physicians on numerous occasions, and billed Medicare and Medicaid at the more expensive inpatient level of care even though the treating physicians recommended performing the procedures at the less expensive outpatient or observation level of care.

Second, in 2007, Piedmont allegedly acquired the Atlanta Cardiology Group, a physician practice group, in violation of the federal Anti-Kickback Statute by paying a commercially unreasonable and above fair market value for a catheterization lab partly owned by the practice group, Pak said.

The Piedmont Healthcare settlement resolves a lawsuit filed in the U.S. District Court for the Northern District of Georgia by a former Piedmont physician under the qui tam or whistleblower provisions of the False Claims Act, which permit private citizens to bring lawsuits on behalf the United States and obtain a portion of the government’s recovery. The whistleblower in this case will receive $2,967,400.

“Our watchdog agency will continue to aggressively investigate healthcare providers that attempt to boost their profits by billing Medicare and Medicaid for medically unnecessary services and engaging in kickback schemes,” said Special Agent-in-Charge Derrick L. Jackson, U.S. Department of Health and Human Services Office of Inspector General. “We will not tolerate such greed-fueled schemes, which bilk taxpayer-funded health care programs and undermine the public’s trust in the healthcare industry.”

Georgia Attorney General Chris Carr added, “Our office will continue to work with our federal partners to ensure that healthcare providers abide by rules that serve as important safeguards for public safety and public resources.”

The case was investigated by the U.S. Attorney’s Office for the Northern District of Georgia, the Georgia Medicaid Fraud Control Unit, and Health and Human Services—Office of the Inspector General, with substantial assistance from the Department of Justice Civil Division, Commercial Litigation Branch (Frauds Section).

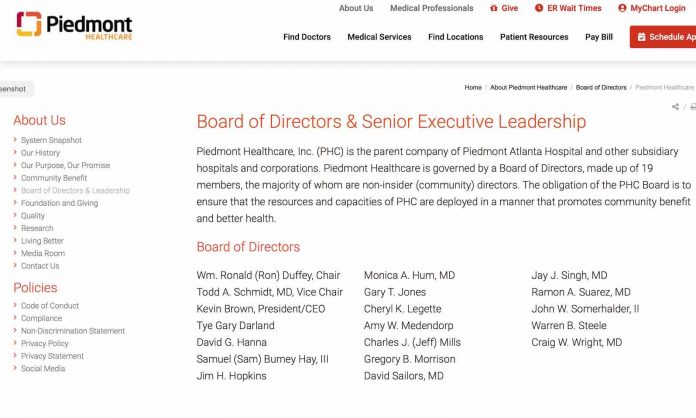

Piedmont Healthcare is a not-for-profit corporation that owns 11 hospitals, operates clinics and offices in over 250 locations, has 22,000 employees and over 2,200 medical staff personnel, according to its website.

Thankful for some oversight on what appears do have been some crooked doings. Thankful to The Citizen for reporting. Couple questions come to mind: 1) I’m not on Medicare, but from talking to folks who are, many of them have supplemental policies which cover what Medicare does not. So if these allegation of up charging are true, did those people incur greater costs? Is there legal redress from them? Class action suit? 2) Are the case managers themselves who allegedly cheated – are they themselves – facing any penalty? Great story, Ben. Thank you again.