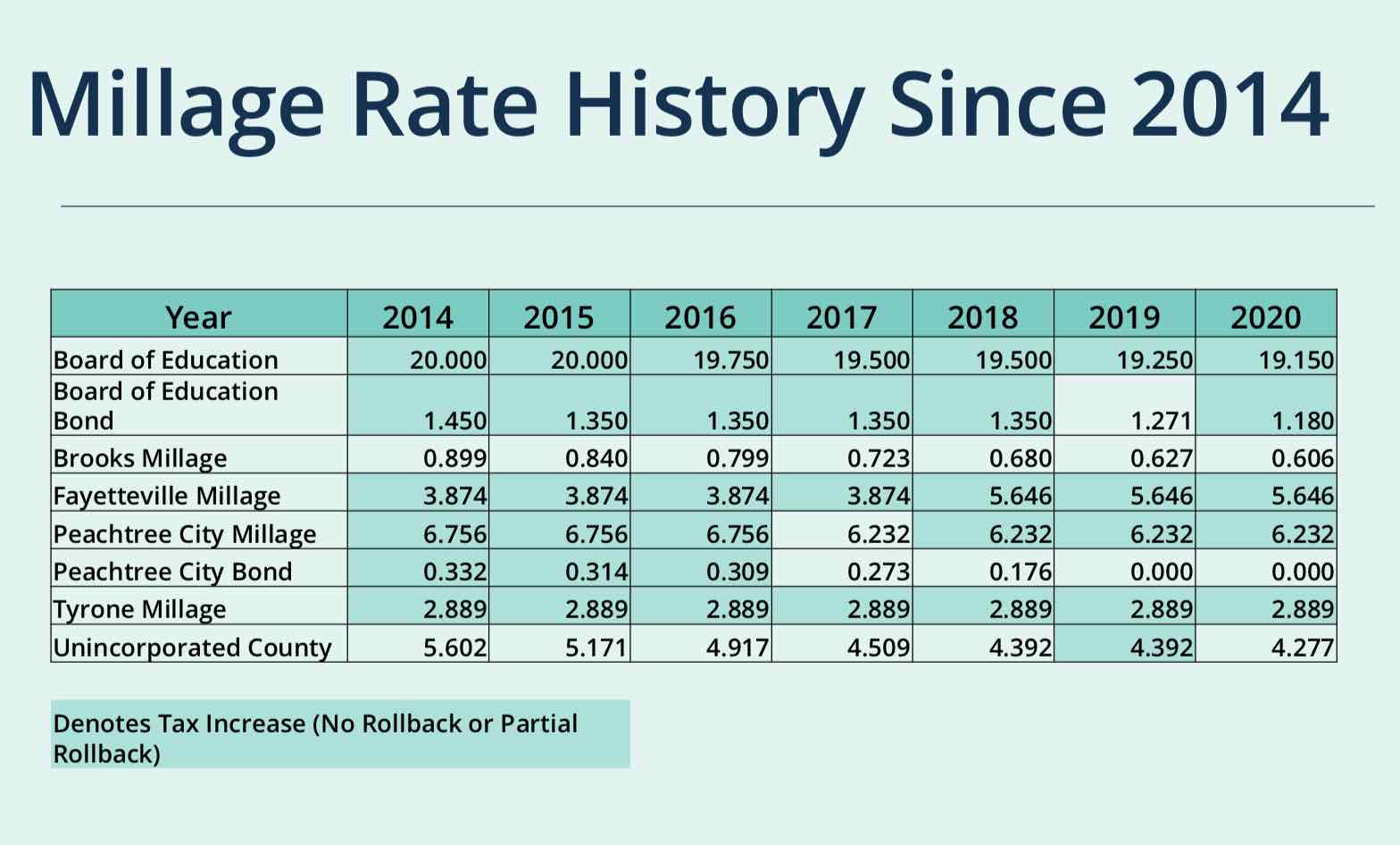

An Aug. 27 millage rate vote by the Fayette County Commission will result in Fayette County property owners seeing no increase in the county’s Maintenance and Operations portion of their tax bill. Such has been the case for six of the past seven years.

The Covid-19 pandemic notwithstanding, the Fayette County Commission adopted a Maintenance and Operations millage rate of 4.277 mills, a full rollback which means no property tax increase over last year.

The 2019 rate was 4.392 mills. Maintaining that rate would have meant a .115-mill increase, or 2.62 percent.

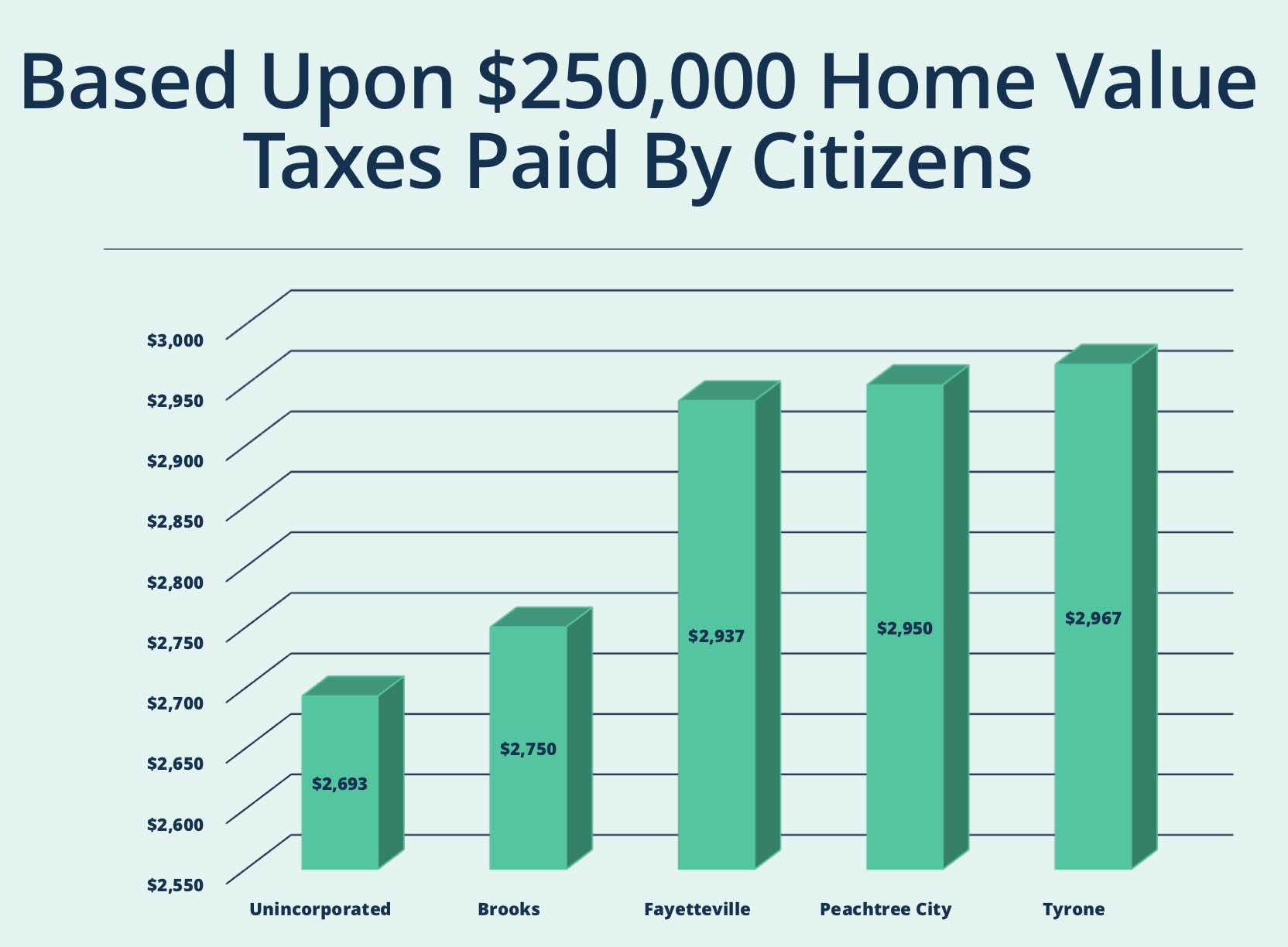

One of the charts during the presentation showed a breakdown of taxes paid for a home in the unincorporated county valued at $250,000, with a property tax bill of $2,693.

Of that amount, 71.7 percent ($1,931) goes to the Fayette County Board of Education, 15.1 percent ($407) goes to Fayette County Maintenance and Operation, 10.9 percent ($293) goes to the Fire District, 1.6 percent ($43) goes to EMS and .7 percent ($19) goes to E-911.

The county’s Maintenance and Operations millage rate includes general government, the sheriff’s office, courts, public works, culture and recreation and community development.

Included in the millage rate information packet for the Aug. 27 meeting was a chart showing the 2014-2020 millage rates for all tax levying entities in the county. Only two of those entities, Brooks and the county, over six of the past seven years have adopted a full rollback on property taxes.

Leave a Comment

You must be logged in to post a comment.