While the Peachtree City government plans no tax rate increase for Fiscal Year 2024, it does plan to spend 12% more of your local property taxes.

That’s because the taxable value of city residents’ property has risen since last year’s tax bills went out, and the same unchanged tax rate will bring in about $5.8 million more this year than it did last year. That comes out of local taxpayers’ pockets.

The planned increase is the latest in a string of property tax increases by default in Peachtree City. Sticking with the same millage rate of 6.043 mills brought in 6.92% more money in FY2022, 7.87% more in FY’23, and is projected to bring in 12.44% more in the fiscal year starting Oct. 1 of this calendar year.

The city plans a budget of $51.4 million total in FY’24, said City Manager Robert Curnow in the June 20 budget workshop. He noted that will mean more money for the city’s rainy day savings fund, bringing it to more than 56% of what it would take to run the city without any other income — a piggy bank of $29.7 million as set-aside, otherwise unencumbered taxpayers’ money.

Curnow said the rainy day fund is projected to drop below 50% in FY2027.

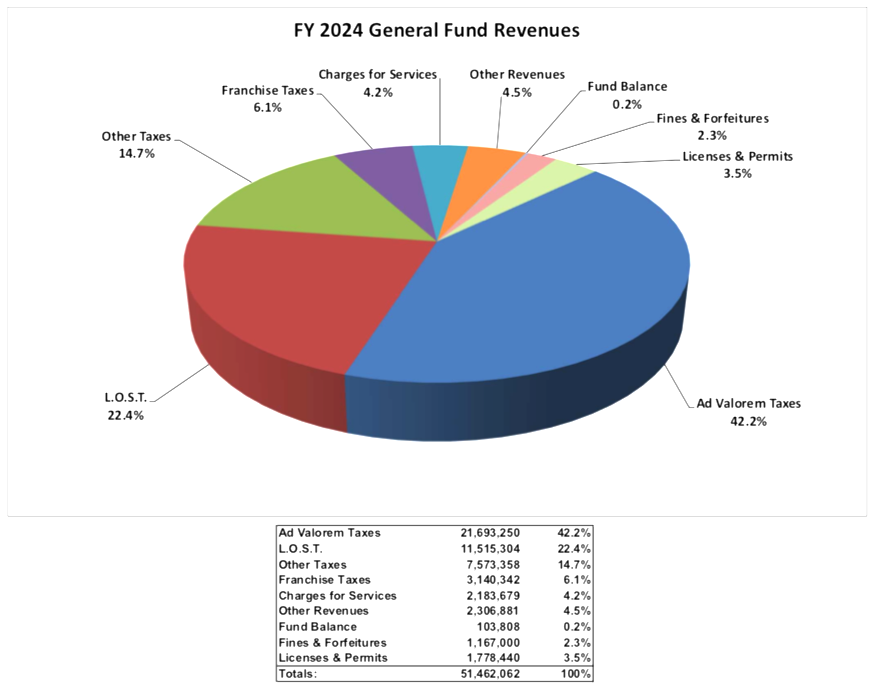

Ad valorem property taxes — what you pay on your house — represent more than 42% of all money the city collects for its general fund, as shown in the chart below.

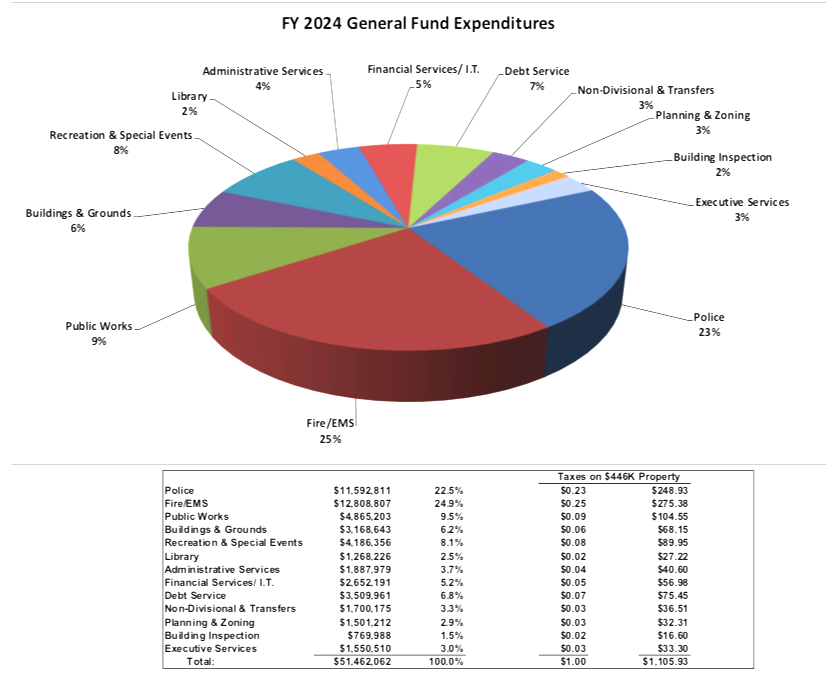

How the general fund money (not SPLOST, the special purpose local option sales tax of one penny on every dollar of local retail sales) is spent is shown in the chart below. The scrollable chart below shows the Peachtree City General Fund FY2024 budget summary:

The scrollable chart below shows the Peachtree City General Fund FY2024 budget summary:

[pdfjs-viewer url=”https://thecitizen.com/wpimport/wp-content/uploads/2023/06/062623_PTC-FY2024-budget-summary.pdf” attachment_id=”109950″ viewer_width=100% viewer_height=800px fullscreen=true download=true print=true]

Leave a Comment

You must be logged in to post a comment.