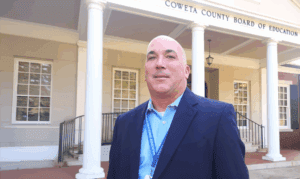

Recently, Coweta County School Superintendent Evan Horton replied to my recent column. While I was unsurprised that he disagreed that the schools could allow the tax payers a break and pause ESPLOST collection, I was disappointed that he made note of my criticism of Coweta schools since moving to my new home without providing or understanding the context of my criticism.

While advocacy of proper funding and resources for public education has been on these pages since 2007 (18 years), my objection has been rooted in the Coweta County School Board’s veto of 62% of its voters decision to adopt HB 581 which limits the runaway property tax growth experienced by Coweta property owners.

In Mr. Horton’s defense, during his advocacy for vetoing the will of the voters, he reminded the school board that the since 2005, the State of Georgia has failed to provide over $100 Million earned in the state’s QBE school funding formula.

In 2009, I had the opportunity to confront the Georgia Senate majority leader at the time about these “austerity reductions” and his reasoning is that “everybody” had an ESPLOST and these reductions were intended to limit “wasteful or extravagant spending”.

To be clear, I have not advocated for eliminating ESPLOST, but rather, to take a break from a “temporary tax” to give tax payers the relief they tried to get under HB 581. The Superintendent and I agree that the schools have needs for periodic maintenance, technological upgrades, Textbook upgrades, and other capital needs and ESPLOST can provide that.

After nearly thirty years and nearly one billion dollars in ESPLOST funds, it is reasonable to presume that all maintenance and upgrades are up to date. In his response, the Superintendent argues that without a never ending ESPLOST, the quality schools would immediately decline. I would hope after such an investment, a small pause would not be so immediate.

However, some worry that if an ESPLOST is paused; the public may not approve another as it becomes a “new tax” versus “just another renewal of a temporary (yet never ending) tax”. The FCBOE, in partnership with our intrepid citizen committee, proved then the public will approve if given the facts in a transparent and respectful way.

In these economic times, many families are stretching their dollars and delaying replacing the family car with the newest model. Superintendent Horton mentions that a portion of his ESPLOST is slated to replace school buses. How old are the buses being replaced? During Fayette’s ESPLOST I, FCBOE was replacing twenty year old buses. After six ESPLOSTs, how many school buses are in urgent need of replacement?

Superintendent Horton correctly notes that I have questioned the athletic projects on the list which totals $26.5 million or 9.5% of the ESPLOST. For comparison, this ESPLOST contains $3.6 million for security upgrades. We disagree on the urgency of placing so much money into athletics when the focus should be on education. However, special projects like these can get you votes.

For example, some argued for an aquatic center in Fayette’s ESPLOST I. It did not make the list and we lost citizen committee members but won by just over 200 votes. One PTSO president demanded turf fields in ESPLOST II or they would oppose the ESPLOST. We lost every precinct in the school’s attendance district but won by 500 votes overall. Before ESPLOST III, both citizen committees were approached to include half the funding for an arts center at Trillith. Neither the county nor the schools included it on their list, but I noticed a nice new building going up last time I was over that way, without public money.

End of the day this is a matter of perspective. Both Superintendent Horton and I support quality education in Coweta County. We disagree on whether there should be respectful limits on taxation during a time when many tax payers are struggling. While some argue “you can’t spend enough on education”, I disagree. We can have great public schools at reasonable cost.

In these economic times, many have either have gone without an annual cost of living raise or minimal at best. When school taxes are increasing at a rate of more than four percent per annum, a reasonable person can see why tax payers are calling for tax relief especially when the taxpayers do not have any additional cash from “the increase in value” of their home.

Superintendent Horton has argued that the CCBOE does not set property values only the school tax millage rate. As I wrote earlier, by taking the more than $15 million into his new budget, the CCBOE has raised taxes by not offsetting the increase. However, in fairness, some of these increases were driven by increases in rates from the State of Georgia.

But again, it is a matter of perspective. In 2022, according to www.openga.gov, Superintendent Horton was reported at $231,089 in compensation. In 2024 (last year reported) he had $301,558.96 in compensation or a more than 30% increase in two years. From that perspective, the growth in Coweta school tax may seem reasonable. But to be clear, this compensation seems to be in line with systems of similar size, including Fayette.

I appreciate the respectful discussion on this topic. While there will always be differing opinions, I hope as we all work to defrost the relationship with all citizens and the Coweta County School System, we can continue to have respectful and reasonable discussion as we all seek to support our teachers, students, and administrators.

However, I still plan on voting no on Coweta’s seventh consecutive ESPLOST.

Leave a Comment

You must be logged in to post a comment.