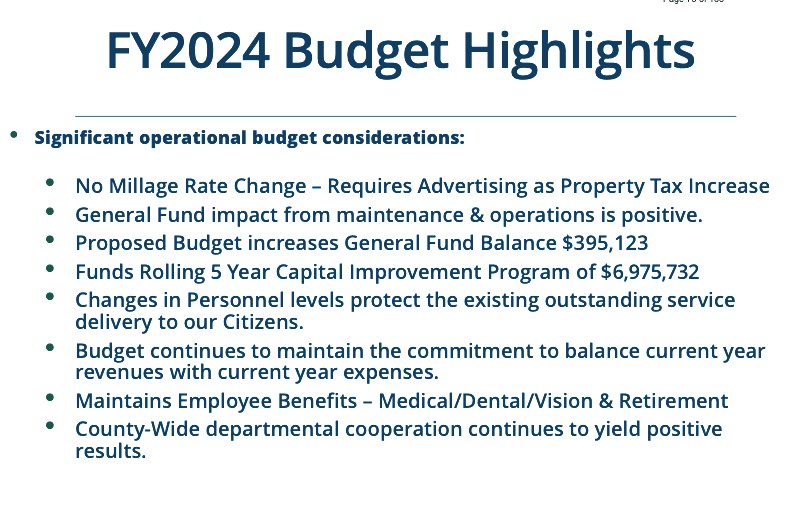

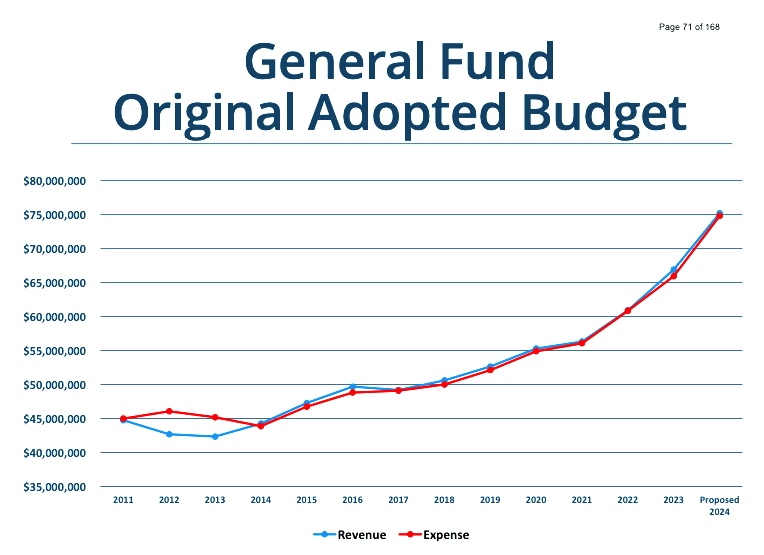

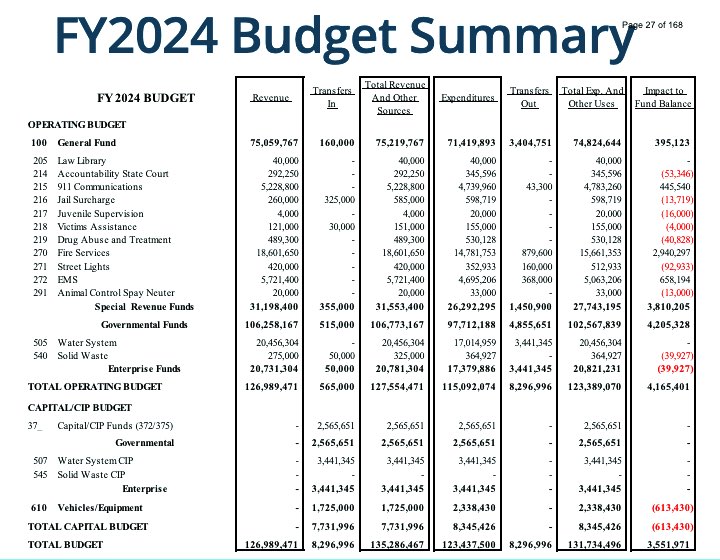

The Fayette County Commission plans to hold a second budget public hearing and then adopt the $75 million general fund operating budget at the Thursday, June 22 meeting at 5 p.m. at the county administrative center in Fayetteville. The first hearing was held June 8.

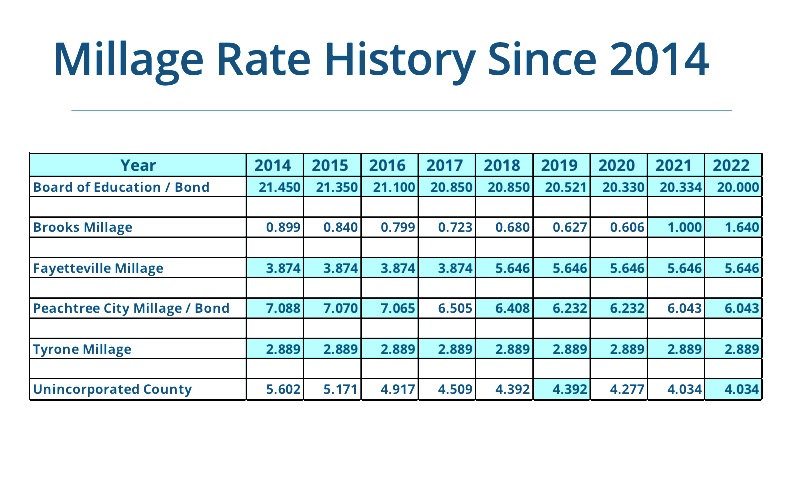

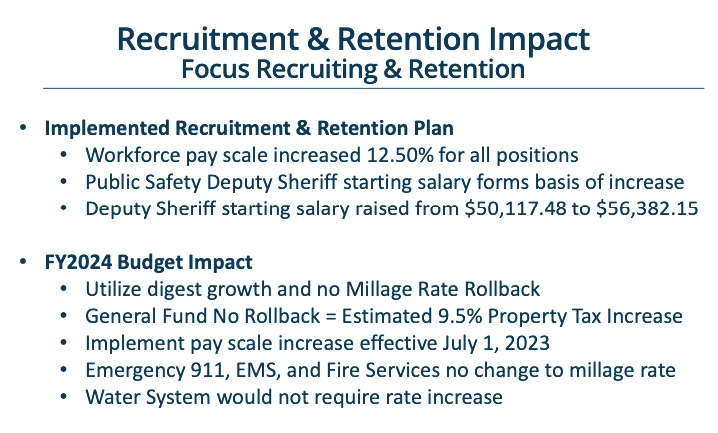

The county plans to maintain its current millage rate. But there’s a catch: To bring in that money into county coffers will require an effective 9.5% property tax increase for most property owners. It’s not a tax millage rate hike, but keeping the same millage rate will bring in nearly 10% more tax revenue in the coming fiscal year than it did in the current year. Simply put, if your property has risen in assessed value since last year, your tax bills will increase accordingly.

The county-owned water system and solid waste budgets bring the total revenues of the operating budget to just under $127 million. Both systems basically pay their own way with user fees.

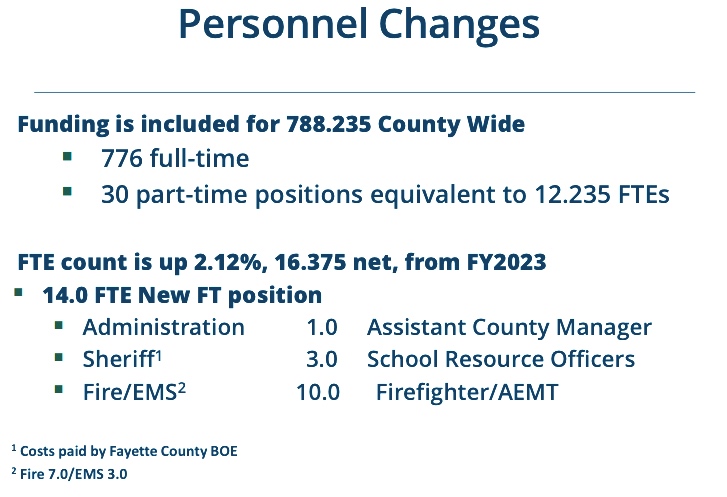

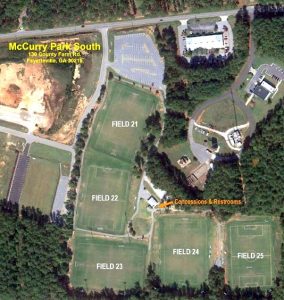

Below are graphics from the budget presentation:

Leave a Comment

You must be logged in to post a comment.